Nice Tips About How To Choose Health Insurance Deductible

The categories are based on how you.

How to choose health insurance deductible. A health insurance deductible is the amount of money you agree to pay for covered services before your health insurance company begins to pay. For example, if you have a. Any medications you take that have been prescribed by your doctor.

The benefits of a health insurance deductible are given below: If you do not already have a photo health card, you must also provide three original documents to prove citizenship, ontario residence and identity. The amount you pay for covered health care services before your insurance plan starts to pay.

Our study finds that in 2020,. This means that once you have paid your deductible for the year, your insurance benefits will kick in, and the plan pays 100% of covered medical costs for the rest of the year. With a $2,000 deductible, for example, you pay the first $2,000 of covered.

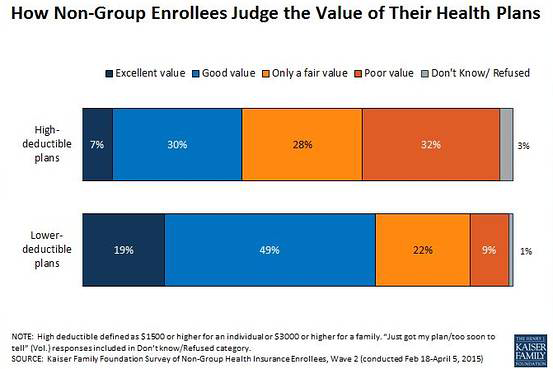

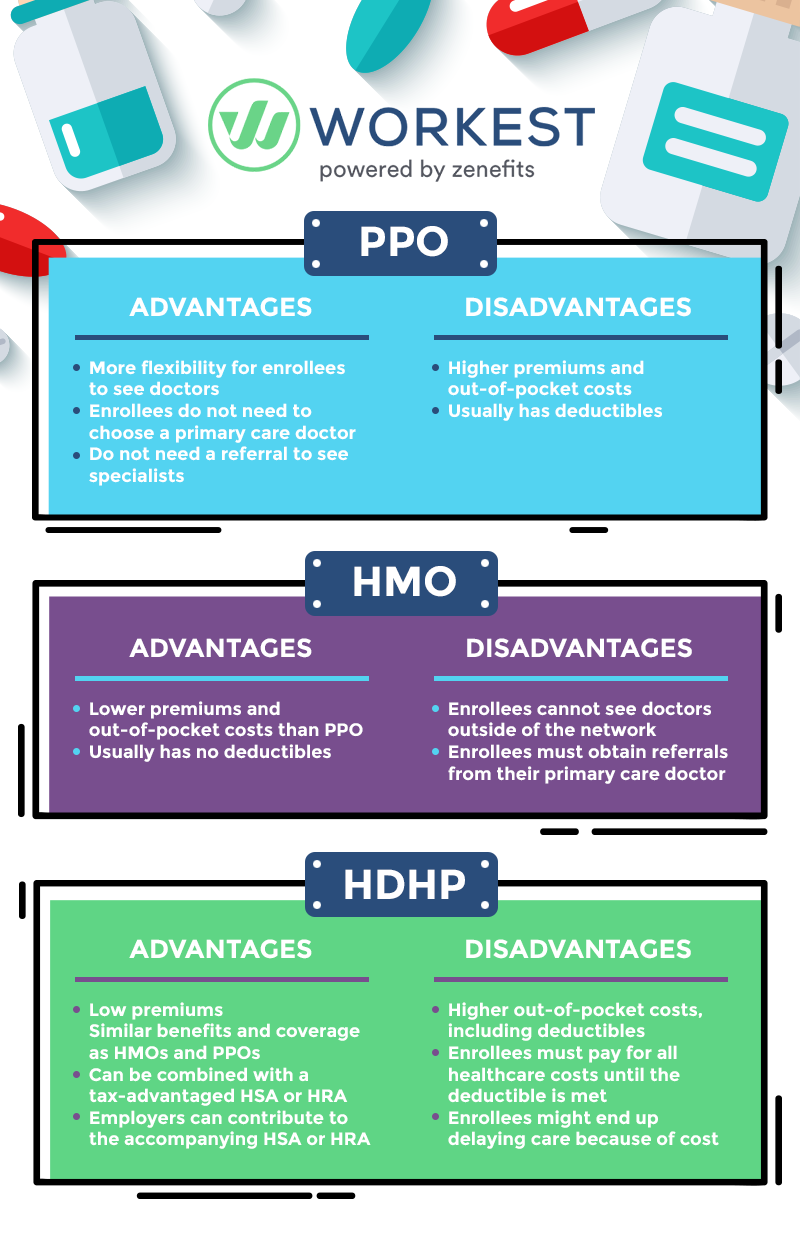

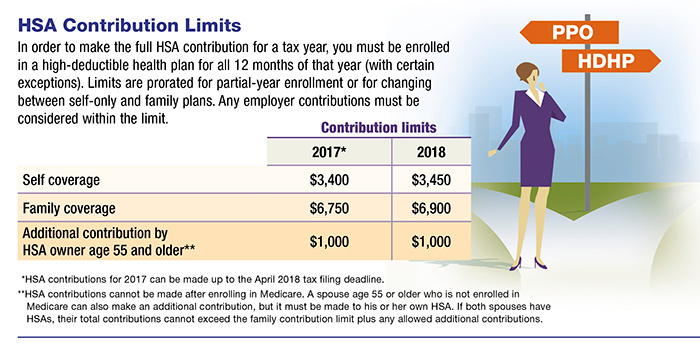

Total costs & “metal” categories. A $1,000 deductible is usually the sweet spot for savings. According to the irs, an hdhp is defined as the following in 2022:

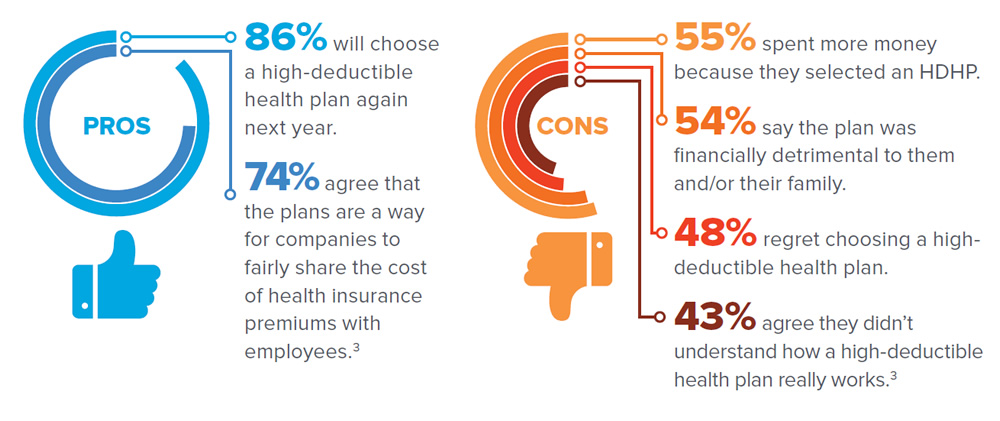

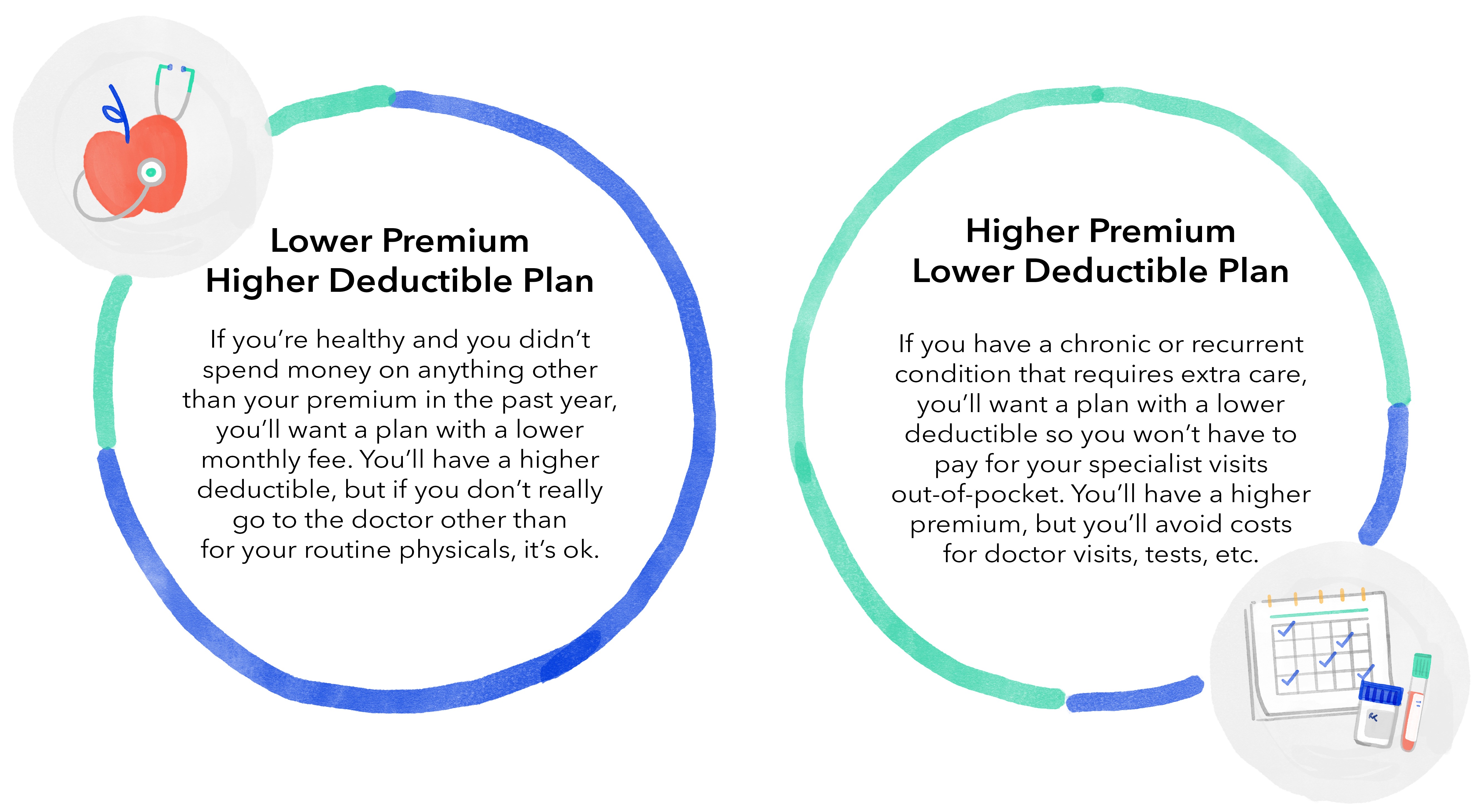

The choice of a high or low deductible plan depends entirely on your and your family’s health, medical needs, and affordability. Any health plan carrying a deductible of at least $1,400 for an individual or $2,800 for a family. How to choose health insurance:

How do i choose a good deductible? Bronze, silver, gold, and platinum. Bronze, silver, gold, and platinum.

![How Does Health Insurance Work? Breaking Down The Basics [Infographic] - Alliance Health](https://www.alliancehealth.com/wp-content/uploads/2020/08/HealthInsuranceDefinitions-410x1024.png)