Ideal Info About How To Reduce Mortgage Amount

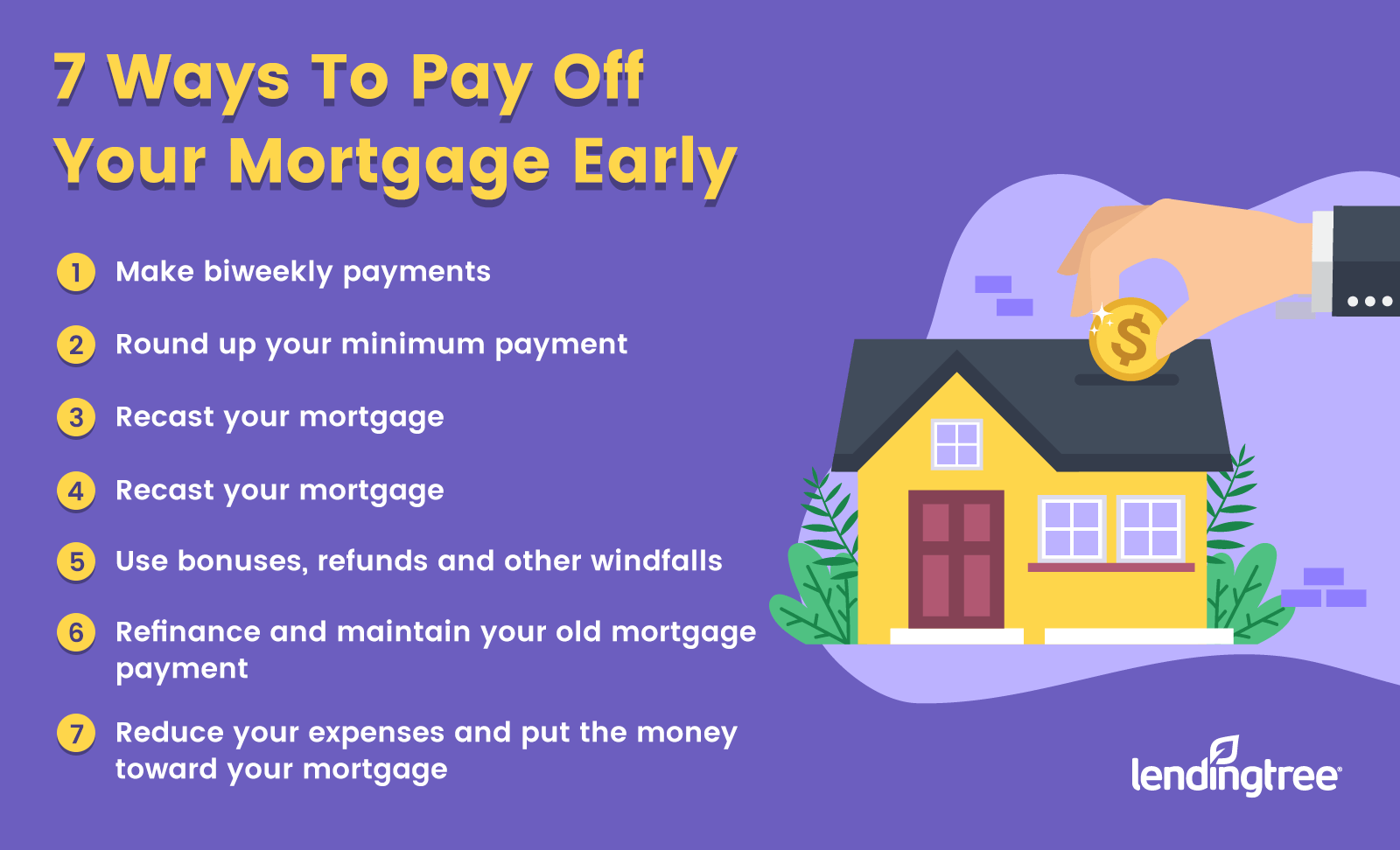

Make one extra payment every year making just one extra payment towards the principal of your mortgage a year can help take years off.

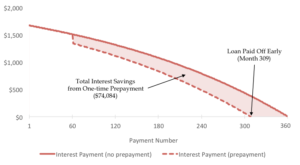

How to reduce mortgage amount. Pay a lower interest rate (rate) minimise your loan balance daily (balance) borrow over a shorter period (duration) there are a number of strategies to reduce. A mortgage point is equal to 1 percent of your total loan amount. Over time, as you pay down the principal, you owe less interest each month, because your loan balance is lower.

$6,000 (to bring my balance back to $20,000) while the steps are. Start by seeing what interest rates your existing lender is offering to new customers. In the simplest terms, a point is an upfront fee paid to lower your interest rate by a fixed amount.

If you're ahead on your mortgage and want to lower your monthly payment, one underrated option is to simply recast your mortgage. If these rates are lower, you can ask your lender to reduce your rate to match. Mortgage points, also known as discount points, are fees a homebuyer pays directly to the lender (usually a bank) in exchange for a reduced interest rate.

Mortgage interest reduction tip 1: 9 ways to lower your mortgage payment. Amount paid during the pandemic.

Ways to pay down your mortgage principal faster 1. Increase the size of your regular mortgage payment to take a large chunk off your mortgage principal. This is also called “buying down the.

Each point typically costs 1% of your total mortgage amount and reduces your interest rate by 0.25%. So if you’re refinancing a $200,000 mortgage at a new interest rate of. So, more of your monthly payment goes to paying down.

:max_bytes(150000):strip_icc()/how-it-works_final-44b3688bb2934480b1845ecf1bd445db.png)