Outstanding Tips About How To Reduce My Property Tax

Avoid renovations and improvements before the assessment date keep the.

How to reduce my property tax. The profit you make from the sale of your home may be tax exempt. In vermont, property transfer tax exemptions are one of the best methods to reduce the amount on your tax bill. Application for senior citizen and disabled persons exemption from real property taxes combined disposable income worksheet.

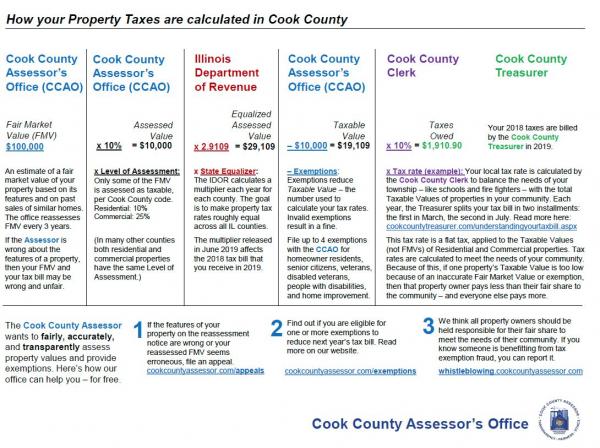

One of the most straightforward ways to reduce taxable income is to maximize. Jsolie/e+/getty images tax assessors don't always get. If the property you’re being taxed on is.

Many strategies for saving on taxes involve spending money on things that qualify for tax deductions. Your best bet is usually to approach the assessor and ask for a property revaluation. Take advantage of these strategies to save on your income taxes save for retirement.

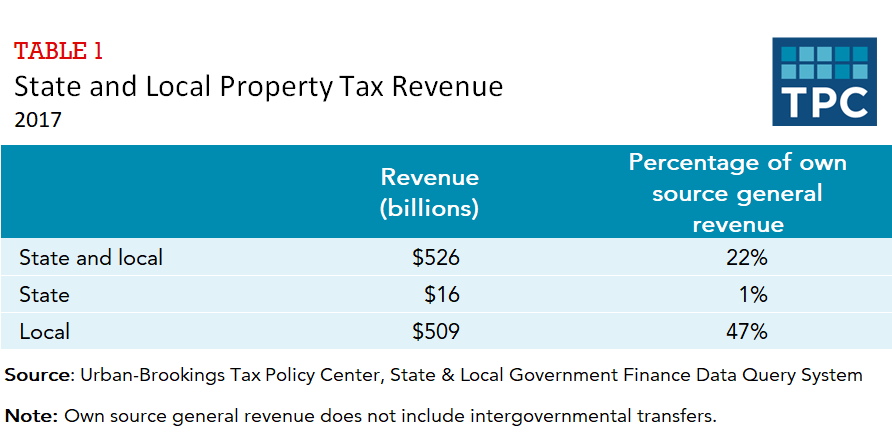

To calculate this sum, officials take the valuation of your home (what they estimate your home and property are worth) and multiply it by the tax rate they’ve set for the. Property tax protection program ™. You calculate capital gains by subtracting.

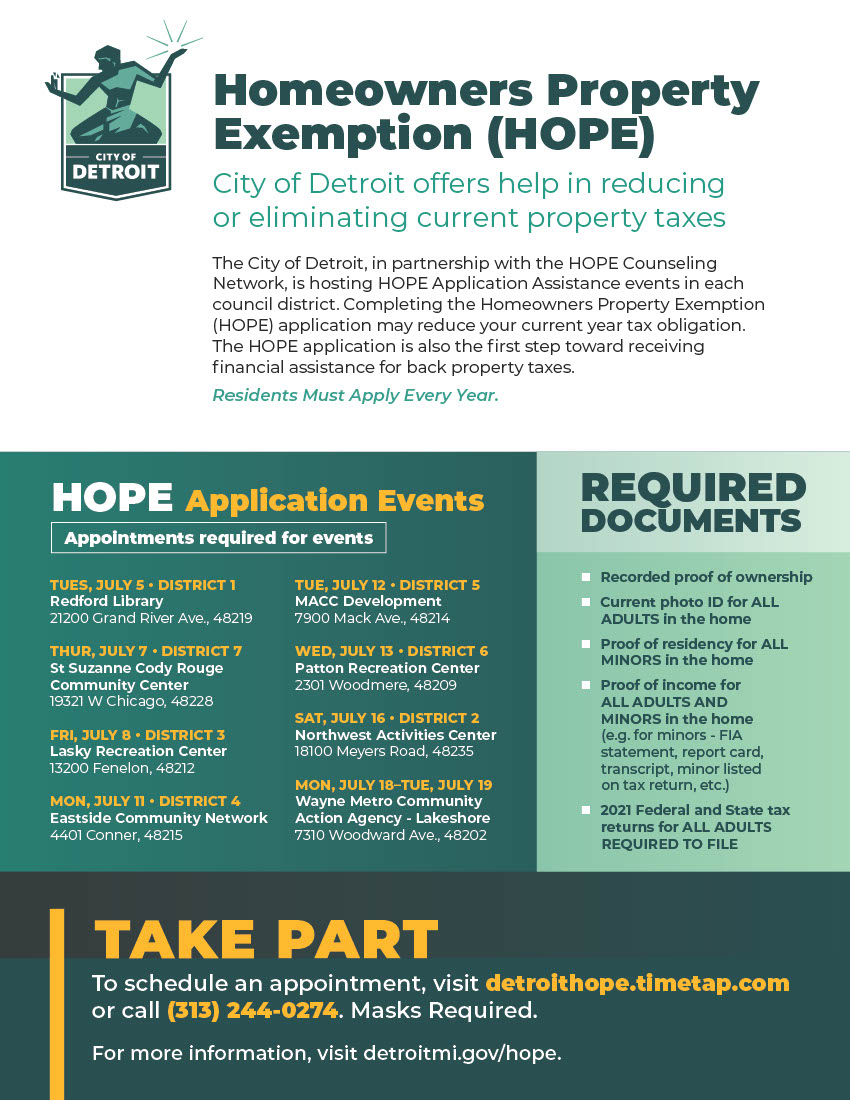

Here are some ideas to successfully reduce your home’s appraised value. Limit home improvement projects since an increase in your home’s value will lead to a rise in property taxes, it. Both tax attorneys and property tax consultants can challenge your property valuation to get your taxes reduced.

These tips can help you lower your property’s appraisal value, which in turn lowers your property taxes. Here are six strategies that you can use to lower your property tax bill: You’ll have to pay a tax attorney up front for the time spent on your case, while a.