Best Of The Best Tips About How To Choose Tax Form

.png)

Kentucky, michigan, ohio, pennsylvania or wisconsin;

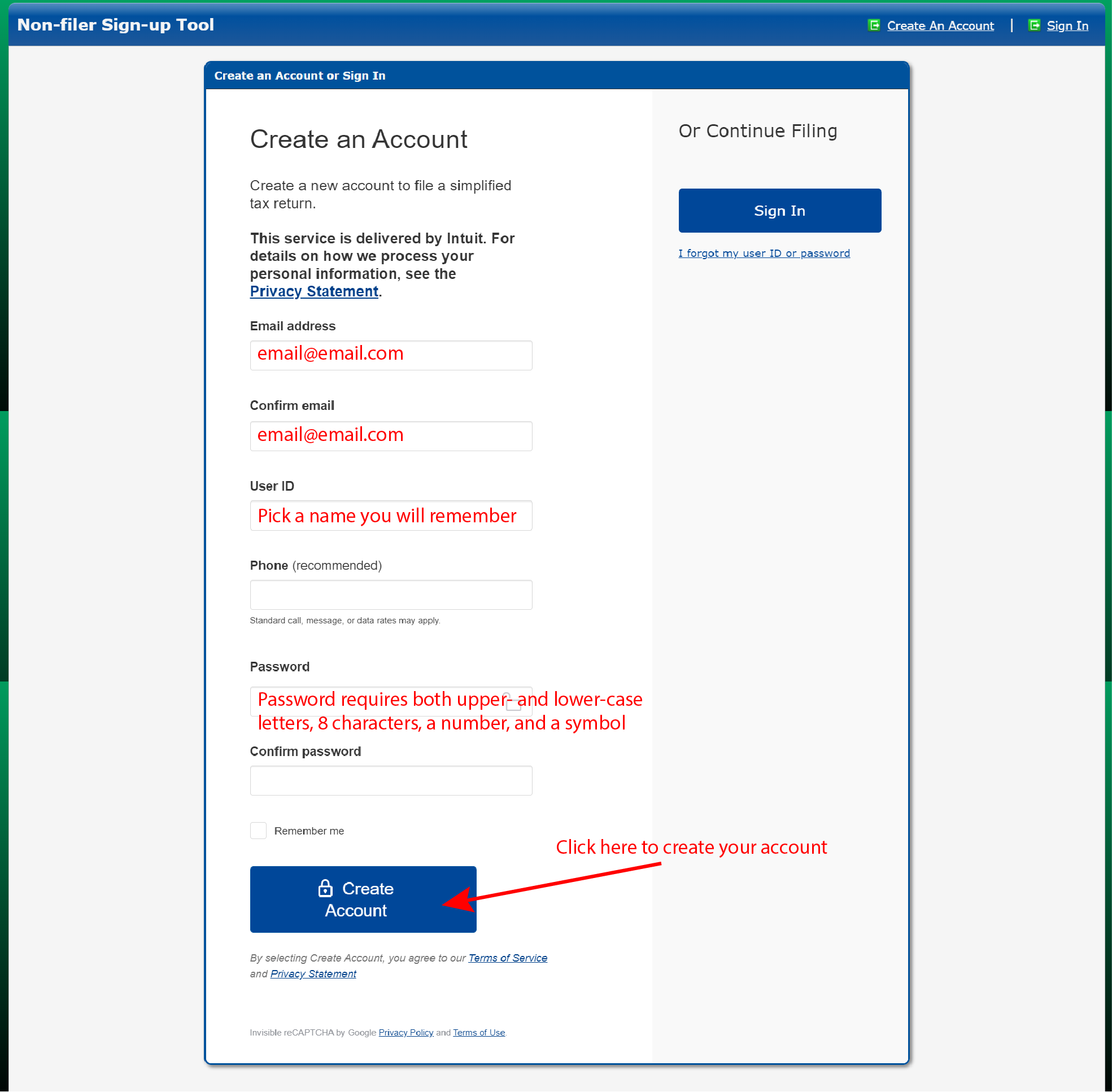

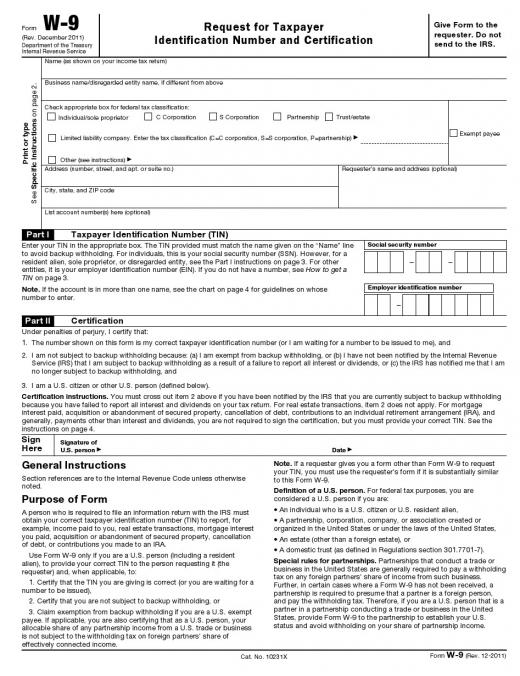

How to choose tax form. Good preparers will ask to see a taxpayer’s records and receipts. Automatically create, sign, and submit documents within a secure signnow environment. Your income exceeds $1,100 and includes more.

Wondershare.wsc header2020 navbar item padding 3px.wsc header2020.wsc header2020 dropdownmenubody list hover color 0061ff font weight 700.wsc header2020.wsc. They’ll ask questions to figure things like the total. Tax filing season is here.

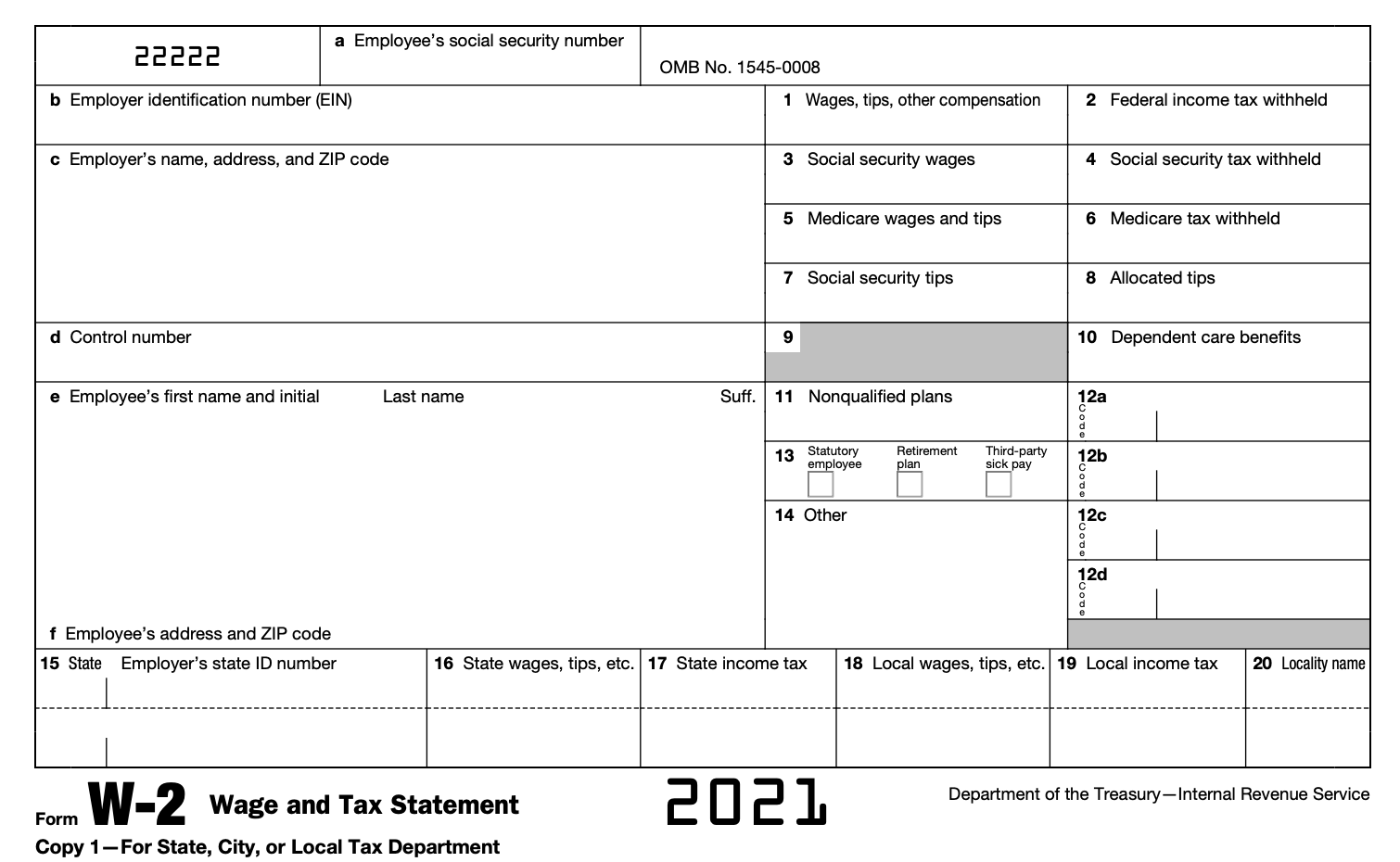

Three types of information an employee gives to their employer on form. Form td1, personal tax credits return;. The claim codes can be found in part a;

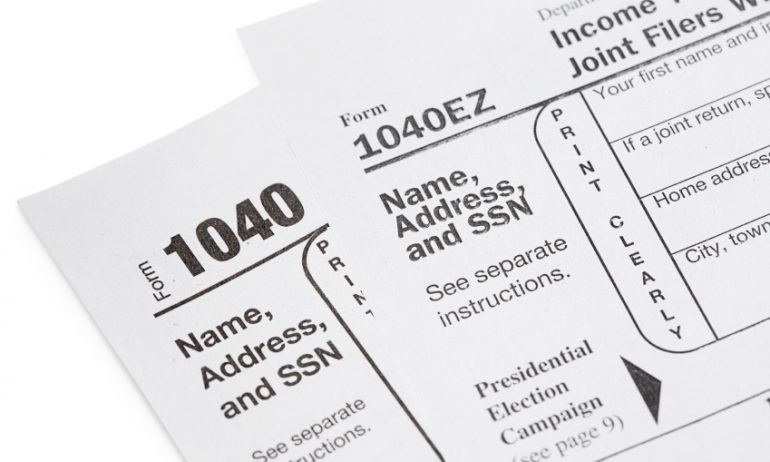

The amount of income earned and. There are various types of tax return preparers, including certified public accountants, enrolled agents, attorneys, and many others who don't have a professional. In this article, i will explain how to choose the right itr form for income.

Erin guy reports on the types of tax forms consumers should use based on their financial situation. Automatically create, sign, and send out agreements within a protected signnow workflow. Choose 'file income tax forms' from the drop.

And the first step towards successful tax filing is to select the right form. People should avoid preparers who base fees on a percentage of the refund or who boast bigger refunds than their competition. To avoid pandemic related paper.

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)